3 Essential QuickBooks Tools to Navigate Tax Season Like a Pro

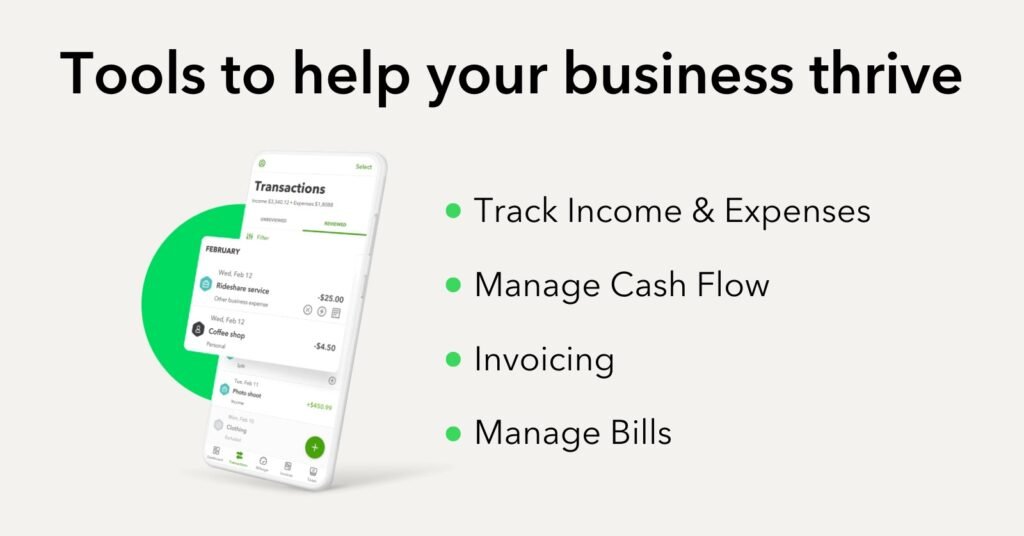

As Tax Season rolls around, small business owners everywhere begin to feel the pressure of getting their financials in order. It\’s a daunting task, but luckily, QuickBooks offers a suite of tools designed to simplify the process, ensuring your business not only survives but thrives during this hectic time. Here\’s a look at three QuickBooks tools that are indispensable for small business owners aiming for a stress-free Tax Season. 1. QuickBooks Online Accountant: Your Financial Hub QuickBooks Online Accountant stands at the forefront of tax preparation and financial management. This tool is specifically designed for accountants and bookkeepers, but its benefits extend directly to small business owners by providing a shared space for financial collaboration. Here\’s how it can help: Centralized Financial Management: Keep all your financial records in one place, from income and expenses to invoices and receipts. Real-Time Collaboration: Share access with your accountant, allowing for real-time updates and changes. This ensures accuracy and can help identify potential tax deductions and credits. Streamlined Tax Preparation: Direct integration with tax software simplifies the filing process, reducing errors and saving time. 2. QuickBooks Self-Employed: Simplify Tax Time For freelancers, independent contractors, and sole proprietors, QuickBooks Self-Employed is a game-changer. This tool is designed with the unique needs of the self-employed in mind, offering features that make navigating Tax Season a breeze: Mileage Tracking: Automatically track miles traveled for business purposes, which can be a significant deduction at tax time. Expense Sorting: Categorize business and personal expenses with a swipe, making it easy to maximize deductions. Quarterly Tax Calculations: Estimate your quarterly taxes so there are no surprises, and stay on top of payments to avoid penalties. 3. QuickBooks Tax Deductions: Maximize Your Returns Maximizing deductions is key to reducing your tax liability, and QuickBooks Tax Deductions offers a comprehensive way to ensure you\’re not leaving money on the table. Whether it\’s office supplies, business travel, or home office expenses, this tool can help you: Identify Deductible Expenses: Automatically categorize expenses that may qualify for deductions, ensuring you\’re taking full advantage of tax-saving opportunities. Organize Receipts: Upload and organize receipts digitally, making it easy to track spending and substantiate deductions during an audit. Deduction Optimization: Provides insights into potential deductions you may not have considered, based on your business type and expenses. Wrapping Up Tax Season doesn\’t have to be a source of stress. With QuickBooks\’ suite of tools, small business owners can navigate this period with confidence, ensuring they\’re prepared, compliant, and possibly even saving money. From streamlined tax preparation to deduction maximization, QuickBooks offers solutions that cater to the diverse needs of the small business community. Start exploring these tools today and turn Tax Season from a time of dread to a period of potential financial opportunity for your business.